Personal Loan Consolidation is a strategic financial tool for UK residents aiming to simplify debt management. It combines multiple high-interest debts into one loan with lower rates, making budget planning easier and saving money on interest charges over time. This approach offers secured, unsecured, or hybrid options to suit diverse financial situations, helping borrowers rebuild their credit score and achieve long-term stability.

“Exploring Personal Loan Consolidation: Secured vs. Unsecured Options in the UK

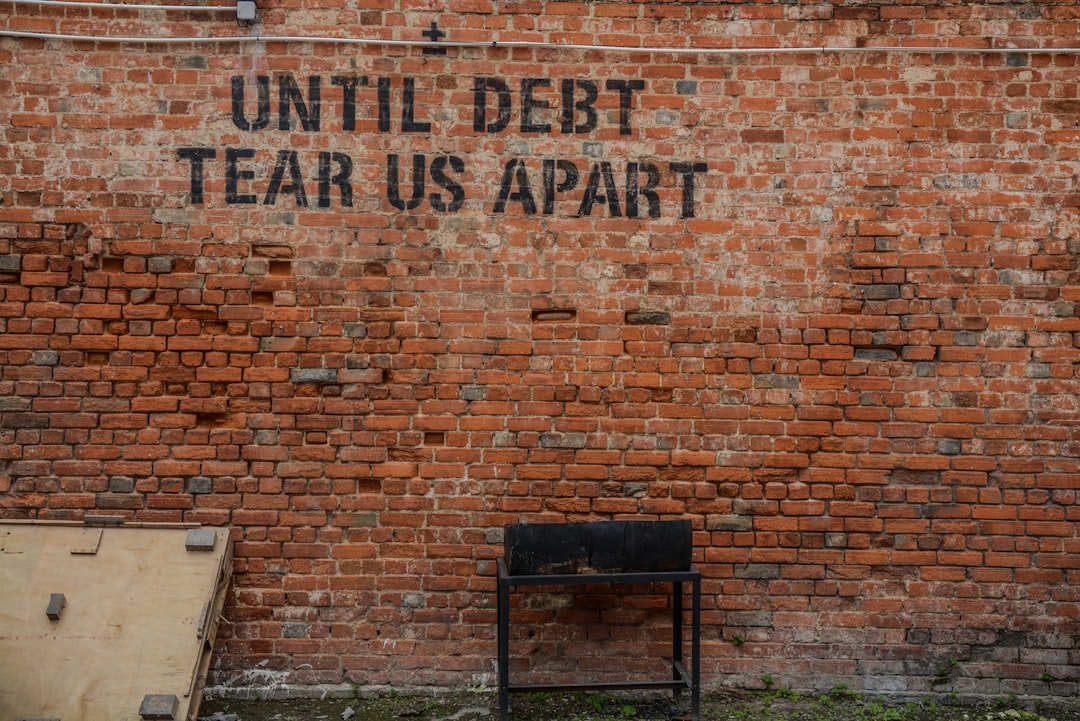

Debt consolidation loans offer a strategic path to financial freedom, allowing borrowers in the UK to streamline multiple debts into one manageable repayment. This article delves into the world of personal loan consolidation, focusing on secured and unsecured options—or the hybrid combination. We’ll uncover the nuances of each type, their benefits, and potential pitfalls, guided by expert insights. Understanding these variations is key to making an informed decision, tailored to your unique financial landscape.”

Understanding Debt Consolidation Loans

Debt consolidation loans are a popular financial tool used by many UK residents to manage and reduce their debt burden. This process involves taking out a new loan with a lower interest rate, which is then used to pay off multiple existing debts. The primary goal is to simplify repayment by combining several debts into one, often resulting in reduced monthly payments and the potential for saving on interest charges over time.

Personal Loan Consolidation can be achieved through secured or unsecured loans or a hybrid approach. Secured loans use an asset as collateral, such as a property or vehicle, while unsecured loans don’t require any collateral but may have stricter eligibility criteria. Combining both types offers flexibility, catering to different financial situations and needs. It allows borrowers to focus on rebuilding their credit score and achieving long-term financial stability.

– Definition and purpose of debt consolidation loans

Debt consolidation loans are a financial tool designed to simplify and streamline multiple debts into one single loan. This approach offers borrowers a more manageable repayment structure, often with a lower interest rate compared to their original debts. The primary purpose of such loans is to help individuals gain control over their finances by reducing the complexity of managing various debt obligations.

Personal Loan Consolidation allows borrowers in the UK to combine both secured and unsecured debts, or opt for one type exclusively. It provides an opportunity to consolidate credit card debt, personal loans, store cards, and other similar debts into a single repayment, making it easier to budget and potentially saving on interest charges over time.

Debt consolidation loans, whether secured or unsecured, offer a strategic solution for managing personal debt in the UK. By combining multiple debts into one loan with potentially lower interest rates, borrowers can simplify repayment and save money over time. Whether you opt for a secured or unsecured option, or a combination of both, consolidating your debts could be a powerful step towards financial freedom. This approach allows you to focus on paying off your loan rather than multiple creditors, making it an effective strategy for debt reduction and improved financial management.